Flying Clubs can now use Pilot Partner Fleet Management system to automate members submitting Fuel Reimbursements. Pilot Partner Fleet Invoicing system will then handle calculating the reimbursement amount and applying the correct credit to the member’s next invoice. The Fleet Reimbursement module can be customized to several different ways clubs calculate reimbursements.

In most Flying Clubs, members tend to hold on to receipts and submit them in batches weeks or month after the fuel was actually purchased. This practice wrecks havoc on the flying clubs financial forecasts and cash flow. A flying club can go from being cash positive to negative with one batch of receipts being submitted. Pilot Partner Fleet Reimbursement module makes it easy for pilots to submit a receipt in a few quick clicks right as the fuel is being purchased. In turn this allows clubs to enforce a much smaller time window of when reimbursement requests are accepted. Pilot Partner suggests reducing the standard time frame of 30-90 days to 14 days.

Pilots Submitting Receipts

Pilot Partner Fleet Reimbursement Module makes it easy for a pilot to submit a fuel receipt using their mobile phone (iPhone/iPad/Android) or using their computer’s web browser. The easiest way to submit a fuel receipt is immediately when the flight is complete, the engine is shut down and the pilot has the fuel receipt in their hands. The pilot would simply:

Pilot Partner Fleet Reimbursement Module makes it easy for a pilot to submit a fuel receipt using their mobile phone (iPhone/iPad/Android) or using their computer’s web browser. The easiest way to submit a fuel receipt is immediately when the flight is complete, the engine is shut down and the pilot has the fuel receipt in their hands. The pilot would simply:

- Log their Flight in Pilot Partner like Normal with Hobbs/Tach Start & End Time

- Click “Add Reimbursement”

- Take a picture of the receipt with their phone

- Enter the total number of Gallons

- Enter to total cost at the bottom of the receipt

The Fuel Reimbursement is automatically calculated based on club rules and is logged to be added to the next invoice.

See submitting a Fuel Reimbursement in action by watching this YouTube video below:

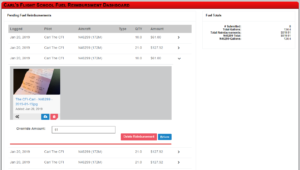

Club Finance Officer Processing Fuel Receipts

The club’s finance officer can review every receipt before processing invoices using the simple Fuel Reimbursement Dashboard. It will allow the officer to quickly view each submission and make corrections or delete the reimbursement from the system. Then the finance officer will generate invoices with the same 1 button press that Pilot Partner has provided since the beginning. When Invoices are generated, the fuel reimbursement will be added as a line item on the invoice.

The club’s finance officer can review every receipt before processing invoices using the simple Fuel Reimbursement Dashboard. It will allow the officer to quickly view each submission and make corrections or delete the reimbursement from the system. Then the finance officer will generate invoices with the same 1 button press that Pilot Partner has provided since the beginning. When Invoices are generated, the fuel reimbursement will be added as a line item on the invoice.

The full process for the Club Finance Officer is:

- Review Pending Reimbursements on the Dashboard (Optional)

- Generate Invoices

Integration with QuickBooks

The Fuel Reimbursement module works with the Pilot Partner integration with quick books. If the Flying Club is using QuickBooks, invoices will be generated in quickbooks with a line item to represent the reimbursement.

There is one exception with the integration in QuickBooks. QuickBooks does not support an invoice with a negative dollar amount. Pilot Partner will add as many Fuel Reimbursements to a QuickBooks invoice as it can until it goes negative. Once that happens, Pilot Partner will create a Credit Memo for that pilot to apply the credit to the Pilot’s account. This happens automatically with no additional effort from the Club’s Finance Officer.

Reimbursement Modes

Pilot Partner Fleet Reimbursement Module supports 2 Primary modes and each mode has a few options that allow for most flying club needs to be met.

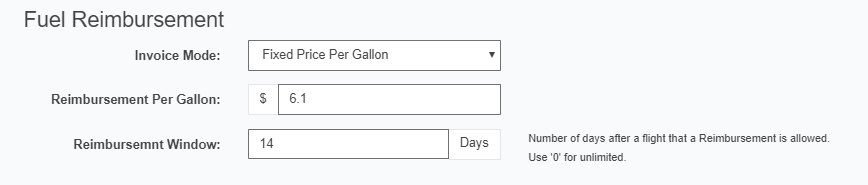

Fixed Price Per Gallon

Fixed Price Per Gallon mode is useful for a club who has a set fixed wet rate that is based on the fuel price per gallon at the home base airport. Pilot Partner’s own flying club is based at Austin Bergstrom Airport where the best price for gas is an astonishing $6.10 a gallon. This sets the wet rate at $100/hr for the club aircraft including 10 gallons an hour at $6.10. When members purchase fuel a nearby airport for $3.30 a gallon, they submit a receipt for their purchase and are reimbursed $6.10 a gallon for each gallon purchased. This decreases the overall cost to fly based on how much cheaper gas can be off field. The reverse is also true, if a member lands at an airport with more expensive fuel than the home base, the member is effectively paying a hire rate to fly the aircraft.

This model works well because it puts the member in control of how much it costs to fly based on the cost of fuel. This is no different than a pilot who is the sole owner of an aircraft, the cheaper the fuel, the cheaper it is to fly.

This model works well because it puts the member in control of how much it costs to fly based on the cost of fuel. This is no different than a pilot who is the sole owner of an aircraft, the cheaper the fuel, the cheaper it is to fly.

With this mode, the Pilot Partner Fleet Administrator simply enters the current rate per gallon that reimbursements will be made at. The Fleet Administrator can adjust this value as often as is required. It is important to note that when a member logs a fuel receipt, the value that is currently set is used. If a members logs a fuel receipt today for fuel purchased 60 days ago, the rate for today is used. The Fleet Administrator can enter a time window, in number of days, to accept fuel receipts.

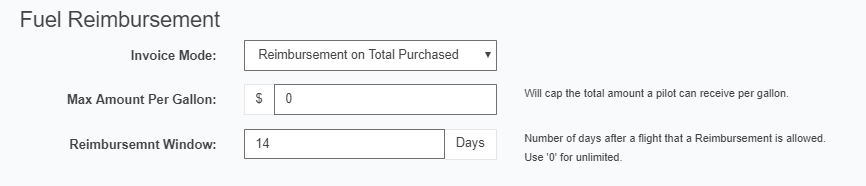

Reimbursement Based on Total Price

Reimbursement based on Total Price allows a Flying Club to pay the member back exactly what they spent for fuel. This is a very common method a lot of Flying Clubs use, although Pilot Partner believes this method has some flaws that should make it a very undesirable way to reimburse for fuel purchases. This method is popular because tracking fuel reimbursements is difficult and to do any other method adds a lot of extra on the club treasurer. Although Pilot Partner Fuel Reimbursement Module fully supports this mode, this system makes is automatic and easy allowing the flying club to switch to a more advantageous fuel reimbursement mode.

Using this mode, the Pilot Partner Fleet Administrator can set a maximum price per gallon that will be reimbursed. If a max per gallon is set at $5.50 a gallon and a Pilot buys 20.97 gallons at $3.30 at $3.30 a gallon for a total of $69.20, the pilot will get reimbursed the full $69.20. But if the same 20.97 gallons was purchased at $6.10 a gallon for a total of: $127.92, the pilot would receive a total reimbursement of $115.34.

Using this mode, the Pilot Partner Fleet Administrator can set a maximum price per gallon that will be reimbursed. If a max per gallon is set at $5.50 a gallon and a Pilot buys 20.97 gallons at $3.30 at $3.30 a gallon for a total of $69.20, the pilot will get reimbursed the full $69.20. But if the same 20.97 gallons was purchased at $6.10 a gallon for a total of: $127.92, the pilot would receive a total reimbursement of $115.34.